In section 33 of the Income-tax Act for sub-section 3 the following sub-section shall be substituted namely3 Where in a scheme of amalgamation the amalgamating company sells or otherwise transfers to the amalgamated company any ship machinery or plant in respect of which development rebate has been allowed to the. Meaning of main maximum deposit.

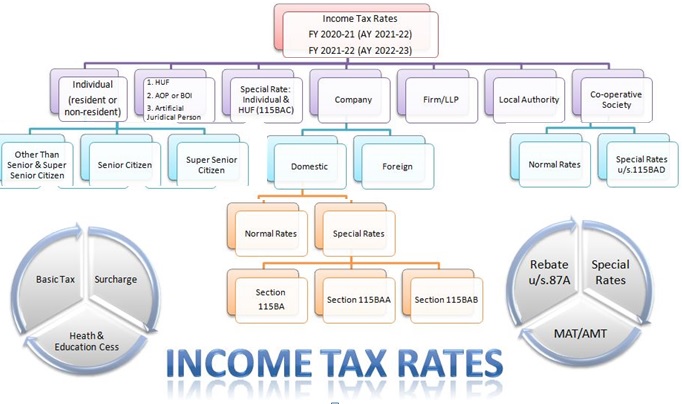

Income Tax Rates For Fy 2020 21 Fy 2021 22

Whether the DGIRs imposition of penalties on the taxpayer for the YAs 2006 to 2009 and.

. 13 Oct 1995 Amended by Act 32 of 1995. He referred to the Privy Council. A dividend and interest.

Amount of tax credit. Ascertainment of chargeable income. And ii Second it provides some examples on arrangements which in CITs view have the purpose or effect of tax avoidance within the meaning of section 331 of the ITA.

July 22 2021 at 433 pm. Section 4 a Income Tax Act 1967 ITA 1967 Real Property Gains Tax Act 1976 RPGTA 1976 Sumur Marketing Sdn Bhd Sumurwang Industries Sdn Bhd V Ketua Pengarah Hasil Dalam. Section 33A of IT Act 1961-2020 provides for development allowance.

Subsection 33 1 of Income Tax Act 1967. Amount treated as repayment for purposes of section CU 17. Current version as at 06 Jun 2022.

EASB V Ketua Pengarah Hasil Dalam Negeri. Section 33 in The Income- Tax Act 1995. Income Tax Act 1947.

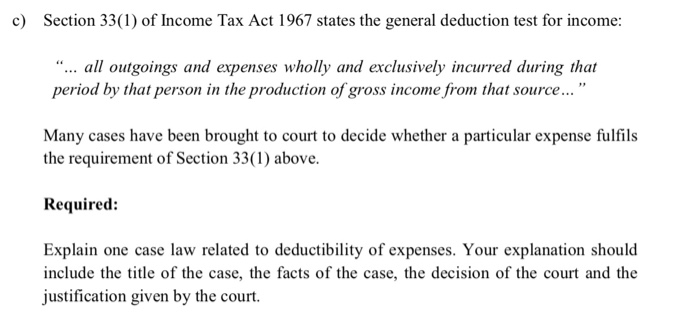

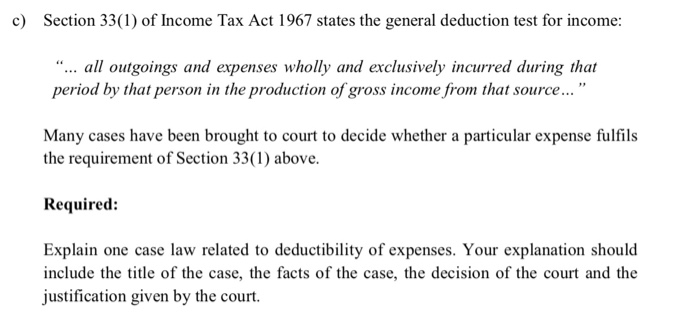

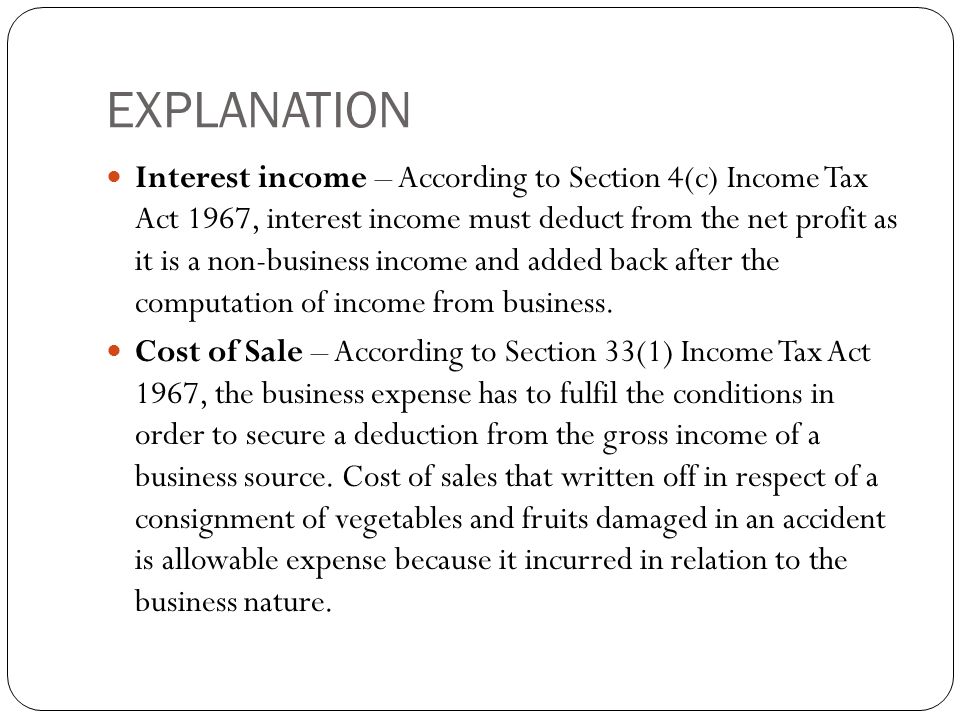

Section 331 of the Malaysian Income Tax Act 1967 the ITA provides that tax deduction will be given for expens- es wholly and exclusively incurred. Section 331 of the Income Tax Act 1967 ITA reads as follows. In the production of gross income.

Part 6 CAPITAL ALLOWANCES. Full name in block letters 2Name of father or husband. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by.

Amendment of section 33. Meaning of income from forestry. The amended provision of section 33A is effective for financial year 2020-21 relevant to the assessment year 2021-22.

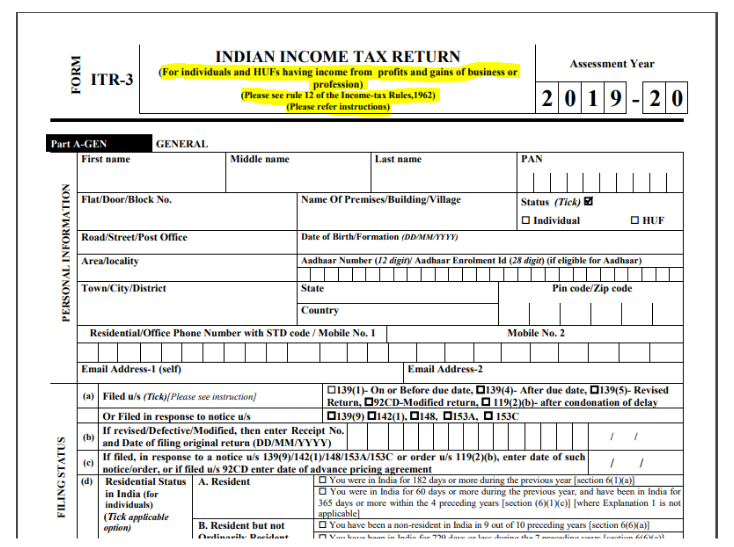

Part 4 EXEMPTION FROM INCOME TAX Part 5 DEDUCTIONS AGAINST INCOME. General provisions as to valuation of benefits. 2019-20 as per the section 112A of the Income Tax Act.

1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and. Personal Income Tax Act CHAPTER P8. Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

Mining company or mining holding company liquidated Repealed Definitions. The Article Discusses about Tax Treatment of Long Term Capital Gain arising from Transfer of Capital Assets under Income Tax Act 1961. B royalties and fees for technical services.

Charge of income tax 3 A. By providing the examples this e-Tax Guide aims to. The words wholly and exclusively refer to the requirement for a sole intention behind the incurrence of the expendi- ture to be established while the phrase.

1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and. Section 1A of section 230 of the Income-tax Act 1961 Folio No. The Gift-tax Act 1958 18 of 1958 the Income-tax Act 1961 43 of 1961 or the Expenditure-tax Act 1987 35 of 1987.

98369 471c renumbered section 32 of this title as this section. Construction of the general anti-avoidance provision in section 33 of the Income Tax Act ITA. Income Tax Act 2007.

Held that the old section 33 was an annihilating section like section 260 of the Australia Income Tax Assessment Act 1936 and section 108 of the Land and Income Tax Act 1954 of New Zealand which was the prede cessor section to the current anti-avoidance provision section 99 of the Income Tax Act 1976. Recently we have discussed in detail section 33 development rebate of IT Act 1961. Section 331 of the Income Tax Act 1967 ITA reads as follows.

The following income of an assessee shall be classified and computed under the head Income from other sources namely-. Short title and commencement 2. 01 Feb 1996 Amended by.

Classes of income on which tax. Net income Repealed CU 20. Under Section 331 of the Income Tax Act 1967 the ITA instead of allowing the taxpayer to deduct the quit rent payments in full under Section 331 of the ITA for the years of assessment YAs 2006 to 2009 and 2011.

98369 474j amended section generally striking out and on tax-free covenant bonds after foreign corporations in section catchline and in text substituting as a credit against the tax imposed by this subtitle for as credits against the tax imposed by. 33 See rule 43. ARRANGEMENT OF SECTIONS PART I Imposition of tax and income chargeable SECTION 1.

GOVERNMENT OF INDIA 1. Section 332 in The Income- Tax Act 1995 2 In the case of a ship acquired or machinery or plant installed after the 31st day of December. Articles discusses Mean.

February 21 2019 at 4. Section 331 of the Income Tax Act 1967 ITA reads as follows. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3.

1 3 a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with. 1a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with and subject to the provisions of this section and of section 34 be allowed a deduction in respect of the previous. Order 53 of the Rules of Court 2012.

Personal relief and relief for children. Income from other sources. Pvt and public Ltd for the same year ie.

Persons on whom tax is to be collected. This certificate is valid for a journey or. C income from letting of machinery plants or furniture belonging to the assessee and also of buildings.

The total income for this purpose being computed without making any allowance under sub- section 1 7 or sub- section 1A 8 of this section or sub- section 1. Today we learn the provisions of section 33A of Income-tax Act 1961. Non-chargeability to tax in respect of offshore business activity 3 C.

Save Tax Up To Rs 45 000 Invest In Mutual Fund Elss Advantages Of Mutualfund Elss Schemes Over Other Tax Saving In Finance Saving Investing Mutuals Funds

The Income Tax A Study Of The History Theory And Practice Of Income Taxation At Home And Abroad Seligman Edwin Robert Anderson 1861 1939 Free Download Income Tax Income Theories

Solved C Section 33 1 Of Income Tax Act 1967 States The Chegg Com

Best Respond To Tax Notice At Kolkata Filing Taxes Bookkeeping Services Income Tax Return

Pin By Vipin Kumar On Vipin Kumar Coding Qr Code Enhancement

Best Proprietorship Registration At Kolkata Income Tax Return Income Tax Return Filing Income Tax

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Income Tax Act 1961 Basics That You Need To Know

Assessments Under Income Tax Act 1961

Blogger S Beat The Business Side Of Blogging Blogging Advice Coding Activities

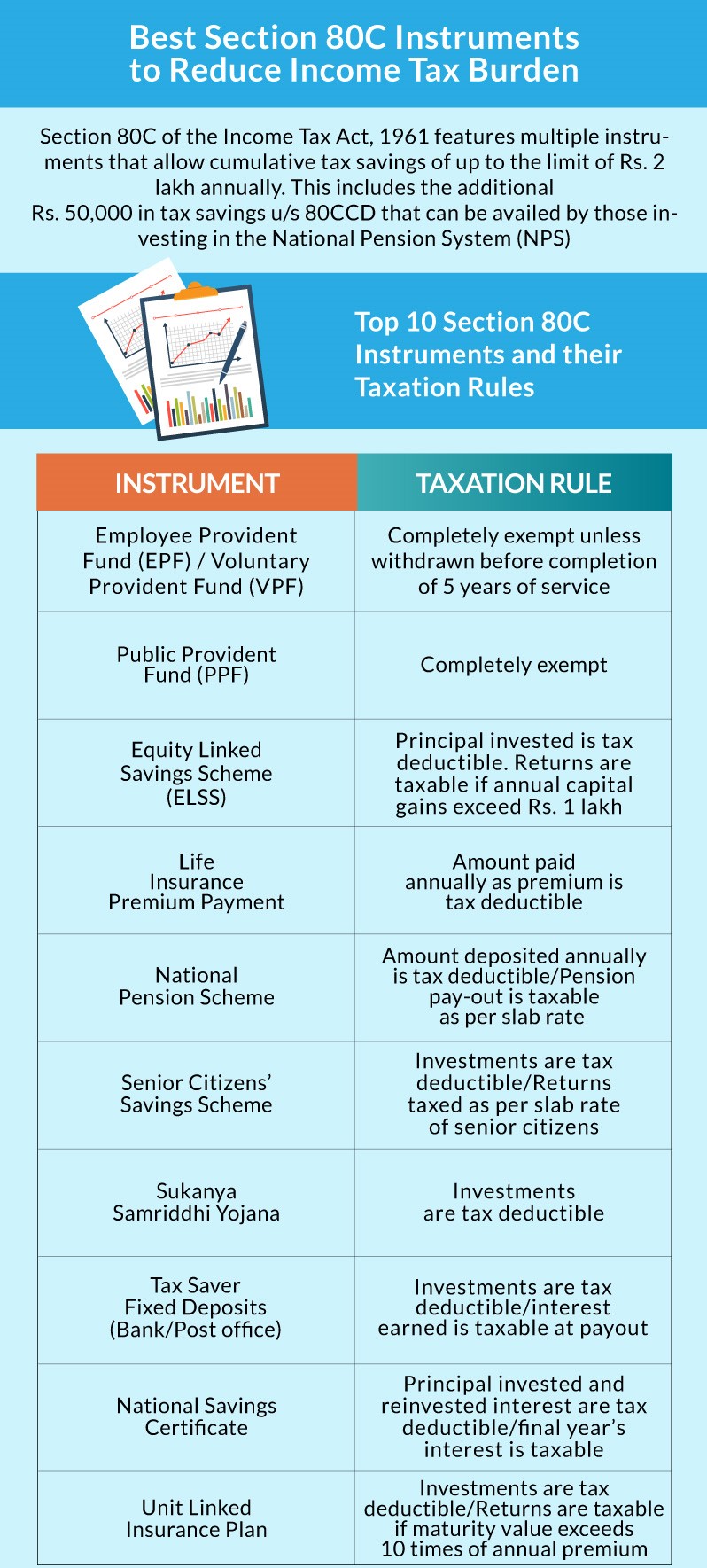

Income Tax Deduction U S 80c 80u Rajput Jain Associates

Section 10 Of Income Tax Act Tax Deductions To Salaried Employees

Our Comprehensive Income Tax Knowledge Book Available At A Nominal Annual Subscription Fee Of Rs 999 Here Are The Unique Fe Income Tax Infographic Tax Rules

Income Tax Return Tax Return Bank Of America

Modified Scheme Of Tax Collection For Salaried Employees Cbdt Sag Infotech Tax Deducted At Source Budgeting Tax

Income Tax Act 1961 Basics That You Need To Know

Section 10 Of Income Tax Act Tax Deductions To Salaried Employees